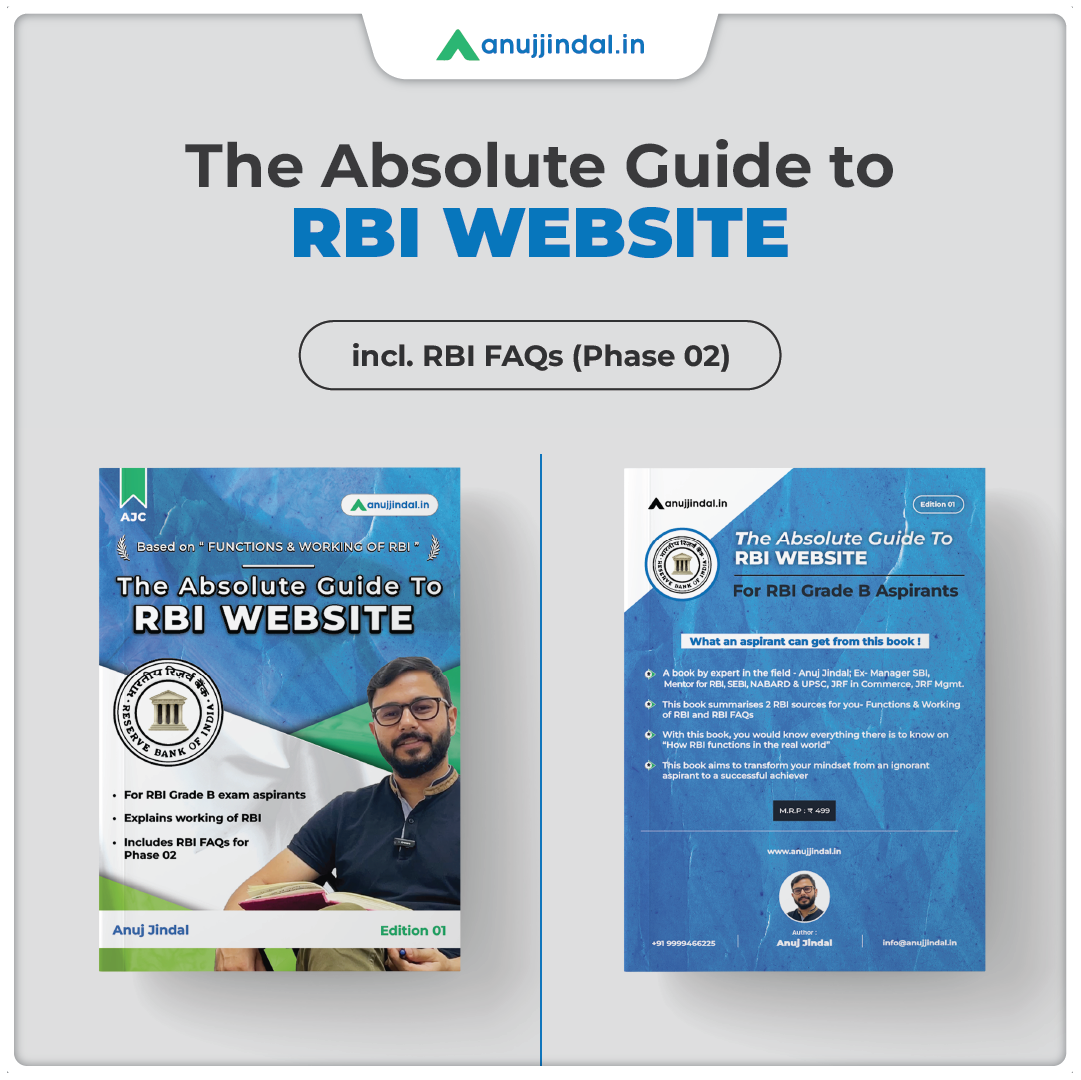

Phase 2 Theory Book

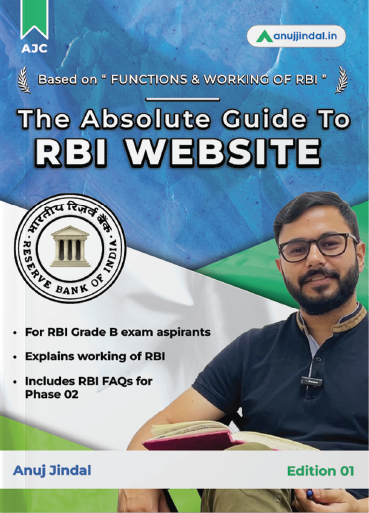

The Absolute Guide to

RBI Website

Click Here to buy this book from amazon

Content

📖

55 Chapters

Language

🌍

English

Print Length

📑

252 Pages

Published on

🗓️

Jun 2022

Content Language

📖 🌍

55 Chapters English

Print Length Publish date

📑 🗓️

252 Pages Sept 2023

I know how overwhelming it can be to prepare for the RBI Grade B exam. As a student, I longed for a guiding compass to light up my journey.

That’s why I created “The Absolute Guide to RBI Website”—a book born from my experiences to help you navigate the complexities of RBI.

This isn’t just another guide; each chapter simplifies complex ideas into easy, digestible explanations, ensuring you truly understand how RBI operates.

Whether you’re prepping for the RBI Grade B exam or just eager to learn more, this guide will be your companion every step of the way.

I know how overwhelming it can be to prepare for the RBI Grade B exam. As a student, I longed for a guiding compass to light up my journey.

That’s why I created “The Absolute Guide to RBI Website”—a book born from my experiences to help you navigate the complexities of RBI.

This isn’t just another guide; each chapter simplifies complex ideas into easy, digestible explanations, ensuring you truly understand how RBI operates.

Whether you’re prepping for the RBI Grade B exam or just eager to learn more, this guide will be your companion every step of the way.

04 Things This Book Will Teach You…

1

Unlock the Secrets of RBI, with two essential sources: “Functions & Working of RBI” and “RBI FAQs.”

2

Gain an understanding of how the RBI functions in the real world with this book as your guide.

3

Transform your mindset from an uninformed aspirant to a successful achiever.

4

Prepare to elevate your knowledge and take a step closer to achieving your goals.

…and much, much more.

04 Things

This Book Will Teach You…

- Unlock the Secrets of RBI, with two essential sources: “Functions & Working of RBI” and “RBI FAQs.”

- Gain an understanding of how the RBI functions in the real world with this book as your guide.

- Transform your mindset from an uninformed aspirant to a successful achiever.

- Prepare to elevate your knowledge and take a step

…and much, much more.

What the book has to offer you

Introduction & Preface

I welcome you to the journey of preparing for the RBI. I would like to congratulate you on taking the bold decision to go after a prestigious exam like the RBI Grade B. However, this is not going to be an easy journey.

Functions & Working of RBI

- Evolution of central banking globally & in india

- Legal framework for reserve bank functions

- Monetary policy framework

- Market operations

- Financial stability

- Overview of the indian financial system

- Regulation of commercial banks

- Supervision of commercial banks

- Regulation and supervision of co-operative banks in india

- Regulation and supervision of non-banking financial companies in india

- Enforcement in RBI

- Development and regulation of financial markets

- Payment and settlement systems

- Currency management

- Banker to banks and governments

- Public debt management

- Understanding the RBI balance sheet

- Foreign exchange management

- Foreign exchange (forex) reserves

- Consumer education and protection

- Financial inclusion and development

- Research, surveys and data dissemination

RBI FAQS

- MSME

- ATM & white label ATM

- Banking ombudsman

- Basic saving bank deposit account

- Inflation indexed bonds

- RBI as banker to government

- External commercial borrowing

- Liberalised remittance scheme

- Accounts in india by non-residents

- Peer to peer lending

- Tokenisation

- Card transaction

- Drawal facility

- Cheque truncation system

- The payment and settlement system ACT 2007

- Prepaid payment instruments

- Priority sector lending

- All you wanted to know about NBFCS

- NEFT and RTGS systems

- Trade receivables discounting system

- Gold monetisation scheme, 2015

- Deposit insurance and credit guarantee corporation (DICGC)

- Indian currency

- Asian clearing union

- Foreign direct investment

- Retail direct scheme

- Sovereign gold bond scheme

- Infrastructure finance companies (IFCs)

- Infrastructure debt funds

- Government securities market in india

- Core investment companies

Click Here to buy this book from amazon

What the book has to offer you

1. Introduction & Preface

I welcome you to the journey of preparing for the RBI. I would like to congratulate you on taking the bold decision to go after a prestigious exam like the RBI Grade B. However, this is not going to be an easy journey.

2. Functions & Working of RBI

- Evolution of central banking globally & in india

- Legal framework for reserve bank functions

- Monetary policy framework

- Market operations

- Financial stability

- Overview of the indian financial system

- Regulation of commercial banks

- Supervision of commercial banks

- Regulation and supervision of co-operative banks in india

- Regulation and supervision of non-banking financial companies in india

- Enforcement in RBI

- Development and regulation of financial markets

- Payment and settlement systems

- Currency management

- Banker to banks and governments

- Public debt management

- Understanding the RBI balance sheet

- Foreign exchange management

- Foreign exchange (forex) reserves

- Consumer education and protection

- Financial inclusion and development

- Research, surveys and data dissemination

3. RBI FAQ’S

- MSME

- ATM & white label ATM

- Banking ombudsman

- Basic saving bank deposit account

- Inflation indexed bonds

- RBI as banker to government

- External commercial borrowing

- Liberalised remittance scheme

- Accounts in india by non-residents

- Peer to peer lending

- Tokenisation

- Card transaction

- Drawal facility

- Cheque truncation system

- The payment and settlement system ACT 2007

- Prepaid payment instruments

- Priority sector lending

- All you wanted to know about NBFCS

- NEFT and RTGS systems

- Trade receivables discounting system

- Gold monetisation scheme, 2015

- Deposit insurance and credit guarantee corporation (DICGC)

- Indian currency

- Asian clearing union

- Foreign direct investment

- Retail direct scheme

- Sovereign gold bond scheme

- Infrastructure finance companies (IFCs)

- Infrastructure debt funds

- Government securities market in india

- Core investment companies

Click Here to buy this book from amazon

What PeopleSay

What People Say

Hey there — if we haven’t

met yet, I’m Anuj 👋

Mentor Edtech Entrepreneur Student Productivity Speaker Traveller Curious Truth Seaker

I am an ex-SBI Manager and Mentor for Government Regulatory Body examinations. Through my presence on YouTube, I guide and inspire thousands of aspirants to achieve their dreams.

So, here I am, trying to provide quality education to students, and this Crash Course is a big part of my mission.

Hey there — if we haven’t

met yet, I’m Anuj 👋

Mentor Edtech Entrepreneur Student Productivity Speaker Traveller Curious Truth Seaker

I am an ex-SBI Manager and Mentor for Government Regulatory Body examinations. Through my presence on YouTube, I guide and inspire thousands of aspirants to achieve their dreams.

So, here I am, trying to provide quality education to students, and this Crash Course is a big part of my mission.